Is pet insurance worth it?

Have you thought about getting insurance for your pets but wondering whether it’s worth it?

Well, pet insurance will help you cater for unexpected vet bills in case your pet suddenly falls sick or gets accidentally injured. This will not only protect your finances but also give you peace of mind.

In this article, we will share real-life stories and experiences with pet insurance, both good and bad, to help you gauge if it’s worth investing in.

Come with us.

Real-Life Stories: The Good

The story of Beqa: Emergency surgery and financial relief

When Dona M. adopted her little Dalmatian puppy, Beqa, her wish was to offer her the best care possible. Dona thus decided to take pet insurance for her beloved pooch. It turns out that this was a good step.

A few months after Beqa had turned one year old, she started having infrequent vomit outbursts, and restlessness, but everything else seemed fine. A visit to a vet later and after x-rays, they would see them go home with medications for stomach upset.

Dona’s furry pal improved for a while but resumed throwing up about a month later. She was taken back to the vet for more examination. The x-ray and blood tests didn’t reveal anything serious, and thus they were sent home with more medication.

However, Beqa’s became worse a week later as she became lethargic, lost all appetite, and began vomiting more frequently. She was rushed back to the vet and was diagnosed with pancreatitis. Despite the medication, she did not show any signs of improvement.

Just then, Dona decided to take her to an emergency vet who carried out an ultrasound that revealed a severe blockage in the dog’s small intestines. An emergency surgery was needed to save Beqa’s life!

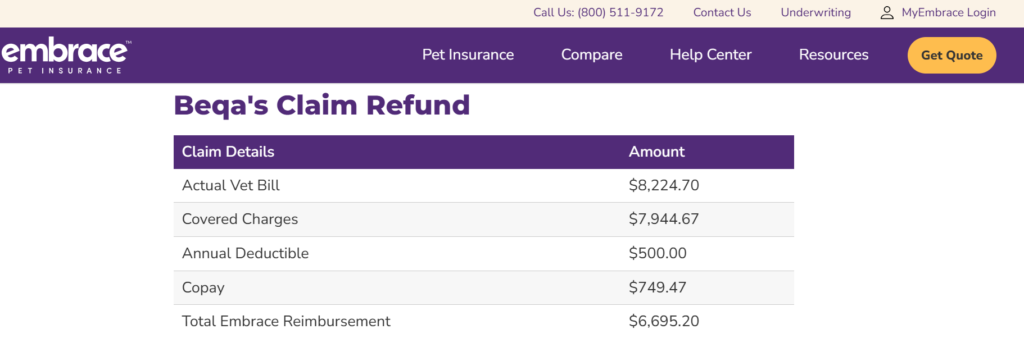

Beqa had a successful operation and was back to her normal happy, playful, and healthy self. After submitting the claim forms, Dola was reimbursed for Beqa’s huge surgery bill without hiccups.

Read the whole story here.

Steve the Cat’s story: Chronic illness management and ongoing support

When Steve, a one-year-old cat, jumped on his parent’s counter and treated himself to a whole jug of dog-calming treats, nobody thought this could be a serious issue as a call to the poisons board ruled out any life-threatening condition.

However, Steve later developed excessive itchiness, which led to sores on his ears. He would also rub his eyes so much, causing ulcers.

Various visits to a dermatological vet would reveal that he had developed a serious allergy, which unfortunately would last for his entire lifetime.

Luckily, with a pet insurance policy that his parents got for him, Steve’s allergy issues are easier to manage as the insurer reimburses up to 80% of the bills.

Read the story here.

Zuma’s story: Preventive care coverage and peace of mind

Just before Zuma’s parents adopted and brought her to her new home as a puppy, they knew she would need to continue receiving her puppy vaccines. This could turn out to be an expensive affair and thus enrolled for a pet insurance policy to help meet the vaccination expenses with ease. This gave them peace of mind knowing that their puppy’s health and welfare needs would be met regardless of their financial condition.

Today, Zuma has grown to be a healthy dog and still continues to enjoy the benefits of pet insurance.

Read all about it here.

Real-Life Stories: The Bad

Kato’s story: Denial of claims and hidden exclusions

By taking a pet insurance plan for their two dogs and a cat, Pappini and her husband thought they were covered financially and would therefore not have to worry about emergency medical expenses for their pets. This plan, which had cost them premiums of hundreds of dollars monthly proved later proved less comprehensive than they had anticipated.

Every now and then, Kato, the couple’s older dog needed to visit a vet mainly for stomach issues. Every time they would pay the bills and submit claim forms for reimbursement. Unfortunately, the couple never got a single reimbursement as the insurer refuted the claims citing it could have been preexisting conditions which are not covered.

See the story here.

The Papini family story: Premiums outweighing benefits for a healthy pet

The Papini family had taken pet insurance and paid hundreds of dollars in combined premiums for their pets including two dogs and a cat.

However, they realized that they really never needed to use the insurance for their younger dog and cat.

Long waiting periods and frustration

Many pet owners complain about how long they need to wait before their claims can be paid. They cite the vigorous claim process, which is frustrating.

This is what one customer had to say:

‘’ I’ve had insurance with a certain company for 7 years. It’s easy to claim, but how long you will have to wait for your money is something else. My dog requires injections for allergies every 8 weeks, that’s all I ever claim for, which is the same amount. My last claim took nearly 4 months to settle; it was only £70, In the end, I lodged a formal complaint and received compensation. One year I never claimed, thinking it would keep renewal costs down but it made no difference. I am now canceling as my renewal has doubled this year.’’

Check the review here.

Tips from Pet Owners

Choosing the right insurance provider

It’s important to ensure that you get the right insurance provider for your pet. First, you’ll need to identify your pet’s specific needs. Next, research thoroughly and compare different insurers and their offers before settling on one. Consider also the coverage options offered by the different insurance companies.

Understanding policy details

Ensure you read and understand the policy fully. Read through the fine print and ask the relevant questions. Pay attention to the limitations and exclusions of different policies.

Being proactive with claims

To avoid frustrations, be proactive with claims. File claims immediately and ensure you attach all the relevant documentation. Then, follow up with the insurer to find out the status of your claims.

Is Pet Insurance Worth It? Final Thoughts

Pet insurance is a blessing, especially in times of medical emergencies. However, choosing the right insurance provider and plan for your pet can be an uphill task. It’s thus crucial to completely evaluate and understand your pet’s needs before deciding on the insurer to settle for. Do proper research and compare different insurers to determine the best.